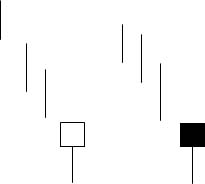

Candlestick: Hammers and Hanging Man

Description

The Hammer is comprised of one candle. It is easily identified by the presence of a small body with a shadow at least two times greater than the body. Found at the bottom of a downtrend, this shows evidence that the bulls started to step in. The color of the small body is not important but a white candle has slightly more bullish implications than the black body. A positive day is required the following day to confirm this signal.

Criteria

- The lower shadow should be at least two times the length of the body.

- The real body is at the upper end of the trading range. The color of the body is not important although a white body should have slightly more bullish implications.

- There should be no upper shadow or a very small upper shadow.

- The following day needs to confirm the Hammer signal with a strong bullish

day.

Signal Enhancements

- The longer the lower shadow, the higher the potential of a reversal occurring.

- A gap down from the previous day's close sets up for a stronger reversal move provided the day after the Hammer signal opens higher.

- Large volume on the Hammer day increases the chances that a blow off day has occurred.

After a downtrend has been in effect, the atmosphere is very bearish. The price opens and starts to trade lower. The bears are still in control. The bulls then step in. They start bringing the price back up towards the top of the trading range. This creates a small body with a large lower shadow. This represents that the bears could not maintain control. The long lower shadow now has the bears questioning whether the decline is still intact. A higher open the next day would confirm that the bulls had taken control.

source: candlestickforum

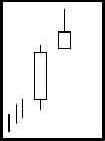

Candlestick: The Shooting Star

Description

The Shooting Star is comprised of one candle. It is easily identified by the presence of a small body with a shadow at least two times greater than the body. It is found at the top of an uptrend. The Japanese named this pattern because it looks like a shooting star falling from the sky with the tail trailing it.

Criteria

- The upper shadow should be at least two times the length of the body.

- The real body is at the lower end of the trading range. The color of the body is not important although a black body should have slightly more bearish implications.

- There should be no lower shadow or a very small lower shadow.

- The following day needs to confirm the Shooting Star signal with a black candle or better yet, a gap down with a lower close.

- The longer the upper shadow, the higher the potential of a reversal occurring.

- A gap up from the previous day's close sets up for a stronger reversal move provided.

- The day after the Shooting Star signal opens lower.

- Large volume on the Shooting Star day increases the chances that a blow-off day has occurred although it is not a necessity.

After a strong up-trend has been in effect, the atmosphere is bullish. The price opens and trades higher. The bulls are in control. But before the end of the day, the bears step in and take the price back down to the lower end of the trading range, creating a small body for the day. This could indicate that the bulls still have control if analyzing a Western bar chart. However, the long upper shadow represents that sellers had started stepping in at these levels. Even though the bulls may have been able to keep the price positive by the end of the day, the evidence of the selling was apparent. A lower open or a black candle the next day reinforces the fact that selling is going on.

Moving Averages Analysis

Moving average is one of the basic and most popular indicators in technical analysis. From the name of this indicator you may already understand that this indicator shows the average price of a security (stock, option, bond, etc) over specified period of time or specified period of bars. There are two most used types of moving average: Simple Moving Average (short name SMA) and Exponential Moving Average (short name EMA). The difference between simple and exponential moving averages is that exponential one uses weighing factors to reduce the lag in simple MA.

The purpose of moving average is to smooth shorter-term price fluctuation within the longer-term trend in order to define the direction of the current longer-term trend. This technical indicator is one of the oldest in technical analysis

and is considered as trend following indicator or a lagging indicator. Price moving averages themselves do not predict coming trend reversals but rather follow the changes in the trend. However, smoothing factor they use allows to filter small price changes and alert when the price-trend change has become critical to consider opening/closing a position.

Moving Averages are widely used in different trading systems to confirm trend as well as generate conservative longer-term trading signals. Over the last several decades technicians have build the number of other technical indicators based on the moving averages which help traders to define price volatility (example could be Standard Deviation indicator), recognize trend direction (as an example - MACD), as a signal line (for instance TRIX with Signal Line) and to smooth other technical indicators such as volume, advances and declines.

MACD and MACD Histogram are one of the most popular technical indicators calculations of which are based on the Moving Averages. In technical analysis MACD is considered as momentum indicator and is used to show the relation between fast (smaller bar period) and slow (bigger bar period) moving averages. This is a simple technical indicator that calculates the difference between two exponential moving averages by oscillating around zero line (center line).

PPO (Percentage Price Oscillator) is another technical indicator that is very similar to MACD. Percentage Price Oscillator is calculated as ration between two moving averages (between fast and slow). It is analyzed and used in the same way MACD is used with the difference that it oscillates around 1 while MACD moves around 0.

Both MACD and PPO reveal the direction of the shorter term trend (fast MA) in relation to the longer term trend (slow MA) and used to generate trading signals from divergence, moving average crossovers and centerline crossovers.

source: articlebase.com

Mastering Psychology Can Make You Rich

You should never underestimate the importance of psychology when it comes to trading the various markets. Many traders believe they will become a master of trading by reading a book. Others by acquiring or developing some magical indicator or system. The truth of the matter is that it takes years of proper trading education along with experience to become a good trader. Some people do become good traders after putting in the time. The key to becoming a great trader is to master the psychology of trading.

The force behind psychology in the marketplace is human emotion. Fear, greed and hope are human emotions that have taken down many traders. A good example would be the emotion of "hope". Let’s say you bought xyz stock. Your xyz stock starts to go against you. The best thing you can do is get out of the stock, taking a small, manageable loss. But you keep watching your stock go lower and lower with the "hope" it will turn around. The emotion of "hope" just caused you a massive loss. The key is to eliminate all emotion when trading the markets. How is this accomplished?

First of all, you need a good sound trading plan to follow. Following your trading plan which includes solid money management is a great start. Then you need to change your way of thinking, modify your behavior. The best traders think differently from the rest. That's why they are great traders. You need to think in terms of "probabilities" once you have an edge in the market because of your sound trading plan. Winning trading doesn't have anything to do with being right or wrong on any particular trade because all trades have an uncertain outcome. You will be able to make a fortune over time because of your edge. Concentrate on the process, not the results. The results will take care of themselves.

The world's best traders and investors can put on a trade without hesitating or having to worry about it. They also can easily admit the trade isn't working and exit with a small loss. They don't let fear rule them, but at the same time, they are not reckless. You must always remember that each trade has an uncertain outcome with the odds in your favor. This is your trading edge. Your attitude is key to winning at nearly everything in life.

What is Stock Market?

Basically, the stock market is a market for a variety of long-term financial instruments that can be bought and sold, either in the form of debt or the capital itself. Financial instruments are traded in the stock market such as stocks, bonds, warrants, rights, convertible bonds, and various derivative products like option.

stock market gives a large role for the economy of a country because stock market provides two functions at once, including the economic and financial functions. stock market said to have a functioning economy since the stock market or provide a vehicle that meets the interests of two parties who have excess funds (investors) and those who need funds (issuer).

With the stock market is a public company can obtain fresh funds through the sale of the Securities IPO shares through the procedure or debt securities (bonds).

stock market is said to have financial functions, since the stock market provides the possibility and opportunity to earn rewards (return) to the owner of the funds, according to the characteristics of the selected investment. So with the expected stock market be increased economic activity due to the stock market is a financing alternative for companies to increase corporate revenue and ultimately to provide prosperity for the wider community.

In general, the benefits from the existence of the stock market are:

• Provide a source of financing (long term) for the business while enabling an optimal allocation of funds.

• Provide a variety of investment vehicles for investors to allow for diversification. Alternative investments provide the potential benefits to the level of risk that can be calculated.

• Provide a leading indicator for the development of a country's economy.

• The spread of ownership of the company until the middle layers of society.

• The spread of ownership, openness and professionalism to create a healthy business climate and encourage the use of professional management.

source: candlestickforum

What is stock?

Shares can be defined as a sign of participation or ownership of a person or entity within a company or limited company.

Form of shares of a piece of paper explaining who owned it. However, now scripless system have been started in the Jakarta stock market where the form of ownership is no longer a given stock sheet owner's name but have a account on behalf of the owner or scripless shares. So the settlement will be the faster and easier.

Shares or equity securities which are already known to many people. Generally known types of shares are ordinary shares (common stock). Own shares divided into two types of shares, namely ordinary shares (common stock) and preferred stock (preferred stock).

Ordinary shares, a stake that puts most junior owner or the end of the distribution of dividends and rights on company property if the company is liquidated (no special privileges). Another characteristics of ordinary shares is the dividends paid during the company's profit.Each shareholder has voting rights in general meeting of shareholders (one share one vote). Ordinary shareholders have limited liability claims against other parties for the proportion of shares and have the right to transfer ownership of its shares to others.

As for preferred stock, a stock which has characteristics of a combination of bonds and common stock, because it can generate a fixed income (such as bond interest). Equation preferred stock with bonds lies in the 3 (three) things: there are claims on profits and assets of the previous, fixed dividend for the period of validity of the shares redeemed and have rights and can be exchanged for common shares.

Preferred stock is safer than common stock because it has a right to claim against the company's assets and the first dividend. difficult preferred stock to be traded as ordinary shares, because the numbers are small.

The attractiveness of stock investments are two advantages to be gained investors by buying stocks or shares, the dividends and capital gains. Dividends are profits given the publishing company's shares on the company profitable. Dividends are usually distributed after the approval of shareholders and conducted once a year.

To be eligible for dividend investors, these investors must hold the stock for a certain period until the ownership of the shares is recognized as a shareholder and entitled to a dividend. Dividends provided the company can be a cash dividend, which investors or shareholders to get cash in accordance with the number of shares owned and stock dividends which the shareholders get a number of additional shares.

As for capital gains is the difference between purchase price and selling price occurred. Capital gains made by the trading activity in the secondary market. For example, say you buy for example Bumi Resources Tbk shares at a price per share is IDR 1800 and sold at a price of IDR 2200 means you get a capital gain of IDR 400 per share. Generally short-term investors to profit from capital gains.

Stocks known to have characteristics of high risk-high return. This means that stocks are securities that provide higher profit opportunities but also potentially high risk.

Shares allow investors a profit (capital gains) in large quantities in a short time. But as stock prices fluctuate, stock can also make investors suffered heavy losses in a short time.

So if you decide to invest in stocks that need to be re-examined is the level of inherent risk (high risk) according to the level of risk you can bear. Do not invest in stocks provides a sense of worry and concern caused you sleepless nights and stress. Know your risk level and make decisions based on it.

In analyzing the existing public company, keep in mind your desire to invest in stocks for long periods with a relatively stable dividend or want the benefits of shorter-term in terms of capital gains due to company growth. As an investor, there are 3 reasons why you chose to buy a particular stock:

1. Income. If your consideration in investing in stocks is to get a steady income from the annual investment return, then you can buy shares in established companies and provide dividends regularly.

2. Growth. If your consideration is for the long term and give great results in the future, investing in shares of companies that are growing (usually a technology company) provides a big advantage, because the policy of the company's growing corporate profits generally will be invested back into the company's corporate does not provide dividends to investors. Benefits for investors only from an increase in stock price when you sell shares in the future (an increase of stock prices).

3. Diversification. If you buy stocks for the benefit of your portfolio should be cautious in complete. Do you need a stock to buy a fixed income or bonds with a given interest as income.

Investing in stocks that are in need of extensive knowledge about the company itself (the company where you want to invest your funds). Many of the questions that may arise and must be answered before deciding to invest in stocks. The first question that you need to know is what company is that? And what do these companies (line of business)? How much debt is owned by the company (debt to equity ratio)? How the development of industry in which they operate, and the development of the company itself?

Information or other knowledge that you need to know is the movement of the stock in recent years from 1, 5, until 10 years ago. And many more other questions. With all the knowledge or information that you can from the above questions, will help provide clarity about the company where you will invest your funds and future prospects of the company.

You'll find plenty of information different from many institutions, You have to learn which institutions have the experience and high credibility so that the information you receive is true and accurate. So the information can help you make decisions about your investments take.